How To Submit Your Income Tax Return (FBR) | Blogen

Here in the easy method how to submit your income-tax return (FBR) 2.0, When you experience these steps you will be able to submit the tax return yourself.

Now you can submit your annual government income tax return without any assistance of anybody.

you just need to follow the given below procedure.

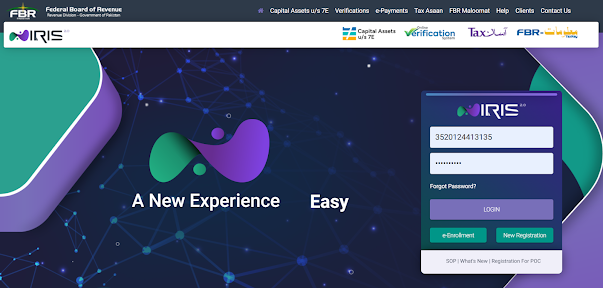

Step 1: Go to Iris (FBR) 2.0 Website using browser Chrome, Internet Explorer, Opera or Firefox and Register yourself and Create account first.

Now you can submit your annual government income tax return without any assistance of anybody.

you just need to follow the given below procedure.

Follow the easy steps and submit your Income Tax Return

Before Proceeding you must have these documents.

1. Bank statement of the fiscal year.

2. Electricity and Gas bills of the last month of fiscal year.

3. A copy of last year income tax return and assets and expenses statement.

4. Expense statement(s) for the recent fiscal year.

Step 2: Login by giving Registration-ID (CNIC) and Password.

(The password & Pin-Code you had already receive when you have registered yourself on iris-FBR website. PWD and PIN-CODE both sent at your E-mail and Cell No. If you forgot the password check your E-mail.)

(The password & Pin-Code you had already receive when you have registered yourself on iris-FBR website. PWD and PIN-CODE both sent at your E-mail and Cell No. If you forgot the password check your E-mail.)

Step 3: Click on "Declaration" Button from top menu

Step 4: From Drop-down click on "116(2) (Statement of Assets / Liabilities filed voluntarily)"

Step 5: Click on "Period" button and enter the year then complete the mention below detail and save it.

i. Personal Expense.

ii. Personal Assets.

iii. Reconciliation of Net Assets.

Step 6: Click on "Declaration" Button from top menu again and click on first option "114(1) (Return of Income filed voluntarily for complete year)"

Step 7: Fill the complete details under 114(1).

Go to “Employment > Salary” and add the figure of your yearly salary in “Income from salary”. Then click “Calculate” at top right corner.

Note: After every entry you must click on “calculate” so that your entry must be calculated.

For Teachers/Disable/Seniors Only:

Go to “Tax chargeable/payments > Computations” and see what is the figure against “Tax chargeable”. Whatever that is you must calculate its rebate. The rebate of full-time teachers is 40%. You can know this easily by calculating the percentage of your yearly tax deducted figure from total tax figure shown by FBR once you have clicked on Calculate button after putting you yearly salary.

Go to “Tax chargeable/payments > Tax Reductions” and put the figure of rebate in “Tax Reduction for Full time Teachers/Researchers” and click on “Calculate” button.

Go to “Tax chargeable/payments > Adjustable Tax” and put the figure of your final tax (Rebate minus) in the column of “Tax Collected / Deducted / Paid” against “Salary of Employees u/s 149” and click the “Calculate” button.

Now go to “Tax chargeable/payments > Computations” and see your “Tax Payable” must be zero (0). If it is zero click on "Save" button.

Final Step 8: Then Click on "Verification" button once you will click on Verification it shall ask for a Pin-Code that you have already received on your mobile and E-mail while registration process and then click on "Submit" button to submit the Tax Return detail, please take out a Print for your proof.

Here is the Full Video Tutorial that will help you how and where to add entries in latest version 2.0

Thank You!

Post a Comment